|

| Basically, any card you have has its own list of benefits, and the better credit cards have extra points or cash-back categories for what you buy frequently. What a trifecta does is build a combination of cards that give you the most cash back or points depending on your preference and goals. Many times the most rewarding trifectas like the American Express Trifecta and the Chase Trifecta with the Chase Sapphire Reserve, while extremely valuable for frequent travelers, have high annual fees that can be prohibitive for those of us who only travel 1-2 times per year. |

Here we will discuss the best trifecta for those who travel for vacations one or two times per year on average and have a credit score of 725 or above.

This is a great cash back trifecta that is even better if you roll the cashback into travel points. Best of all, this trifecta has a small, $95 annual fee on one card, while the other two are free.

We really like the flexibility to be rewarded in cash or points, so that you can have ultimate flexibility in paying for vacations or other things.

This is a great cash back trifecta that is even better if you roll the cashback into travel points. Best of all, this trifecta has a small, $95 annual fee on one card, while the other two are free.

We really like the flexibility to be rewarded in cash or points, so that you can have ultimate flexibility in paying for vacations or other things.

In our experience the Chase Trifecta consisting of the Chase Freedom Unlimited, Chase Freedom Flex, and Chase Sapphire Preferred is the best available for vacation travelers, both domestic and international. We will cover business travelers in a later blog.

Each Chase card suggested and the current benefits and offers

Chase Freedom Flex (Our favorite free card of 2020; get this even if you don't want the trifecta)

The 20,000 point sign-up bonus plus 5% back on groceries for the first year will get you as much as 80,000 points the first year (Worth $800-2000). For a no annual fee credit card this is unheard of outside of the Chase Platform which boast two such cards!

Freedom flex bonuses explained (Limited Time offer)

Additionally, there are very strong permanent categories for everyday spending:

Freedom flex bonuses explained (Limited Time offer)

- You will get $200 cash back (20,000 points) after spending $500 in the first 3 months (40% cash back rate)

- You will get up to $600 cash back (60,000 points) on groceries in the first year based on 5% of all your grocery purchases.

- Complementary DoorDash subscription for the first three months (Value?)

- 5% cash back on Lyft plus a $10 credit every month if you use Lyft 5+ times/month (Value?)

- October-December: Walmart and PayPal 5% back up to $1500

- January-March:

- April-June:

- July-September

Additionally, there are very strong permanent categories for everyday spending:

- 5% on travel purchased through the Chase portal

- 3% on Restaurants

- 3% at drugstores

- And 1% on everything else (only do this if this is the only chase card you get; the 1.5% on the Freedom Unlimited card is better)

- Up to $800 mobile phone insurance (Pay your cell phone bill on this card!)

- Trip cancellation insurance

- Rental car damage waiver

- 1-year additional extended warranty on many items

- Fraud Protection and Credit Monitoring

When you put these all together, this free card should get you between $1000 and $2000 tax free “profit” in the first year, and it can protect many of the things that travelers value most.

If this is the only card you add here, get this card ASAP and get started on being paid back to eat or save the points to start traveling like own hotels on Boardwalk and Park Place.

If this is the only card you add here, get this card ASAP and get started on being paid back to eat or save the points to start traveling like own hotels on Boardwalk and Park Place.

I have attached a YouTube link below for more on the card and how it fits into the Chase Trifecta, but the vlogger chooses the more expensive Chase Sapphire Reserve as he probably travels more and can use all of the higher end bonuses to make up for the higher fees. If you do fly frequently, I can refer you to all chase cards and would love to talk you through it personally. Let me know in the comments below.

Chase Freedom Unlimited (The first card to get in the Chase Trifeceta under most conditions for the differences highlighted in blue below)

Like the Freedom Flex, The 20,000 point sign-up bonus plus 5% back on groceries for the first year will get you as much as 80,000 points the first year (Worth $800-1600) For a no annual fee credit card this is unheard of outside of the Chase Platform. In fact, used correctly, all three cards suggested can be leveraged for 80,000 bonus miles each, currently.

Freedom Unlimited bonuses explained (Limited Time offer)

There are no rotating 5% back categories for this card at this time, but there are many of the same permanent categories for everyday spending. With this card, however, you get unlimited 1.5% cash back on all purchases. Additionally, there are strong permanent categories for everyday spending on this card as well:

Freedom Unlimited bonuses explained (Limited Time offer)

- You will get $200 cash back (20,000 points) after spending $500 in the first 3 months (40% cash back rate)

- You will get up to $600 cash back (60,000 points) on groceries in the first year based on 5% of all your grocery purchases.

- 0% interest for 15 months which can allow you to start accumulating points while paying off other cards or bills

- 5% cash back on Lyft plus a $10 credit every month if you use Lyft 5+ times/month (Value?)

- Complementary DoorDash subscription for the first three months (Value?)

There are no rotating 5% back categories for this card at this time, but there are many of the same permanent categories for everyday spending. With this card, however, you get unlimited 1.5% cash back on all purchases. Additionally, there are strong permanent categories for everyday spending on this card as well:

- 5% on travel purchased through the Chase portal

- 3% on Restaurants

- 3% at drugstores

- 1.5% on all other purchases

- Trip cancellation insurance

- Rental car damage waiver

- 1-year additional extended warranty on many items

- Fraud Protection and Credit Monitoring

If you have other credit card debt, this should be the first card to get due to the 0% interest, but only if it allows you to get caught up. The key to maximizing credit cards is to not pay interest and thus build your credit. Furthermore, if you get this card at a time when you can take advantage of all the welcome bonuses, it will “earn” you $1000 to $2000. It's like found money.

I have attached a YouTube link below for more on the card and how it fits into the Chase Trifecta, but, again, this vlogger chooses the more expensive Chase Sapphire Reserve as he probably travels more and can use all of the higher end bonuses to make up for the higher fees. If you do fly frequently, I can refer you to all chase cards and would love to talk you through it personally. Let me know in the comments below.

Chase Sapphire Preferred (The top-rated travel card under $100, plus one of the best 3-month bonus returns available)

This is the card that doubles the value of the points on the other two cards and it is the key to making these all work towards travel rewards. It currently has a 60,000 mile bonus offer worth $600-$1200, but has recently had this as high as 80,000 points. At either value, this is the best travel card with a less than $100 annual fee, especially when used with the trifecta.

Chase Sapphire Preferred bonus explained

Chase Ultimate Rewards Airline Partners:

Note: All of these transfer partners have different airlines, routes, and the values of their points are different at different times and days. Please see our upcoming blog on maximizing Chase Ultimate Rewards Points for information on the best practices when transferring points to partners. Also, many of these partners have co-branded cards that you may want to add after you get the trifecta if you are sure to be flying with them. Only get co-branded cards if you are sure to use the miles within two years, and you are sure to get the welcome bonus. The rewards are very limiting and using them for everyday expenses is normally on a 1 point per dollar basis. We will have specific approaches based on specific airlines and destinations soon and will list them below as they come available.

Chase Sapphire Preferred bonus explained

- You will get 60,000 points after spending $4000 in the first three months (15% rewards rate)

- 2 points on dining

- 2 points on travel (hotels, flights, taxis and more)

- 2 points on groceries through 4/30/21

- 5 points on Lyft through March 2022

- 1 point on all other purchases

- No foreign transaction fees

- Trip cancellation insurance

- Rental car damage waiver

- 1-year additional extended warranty on many items

- Fraud Protection and Credit Monitoring

- Baggage delay coverage

- Trip delay reimbursement

- Purchase Protection

- Emergency services

- $60 Peloton Credit

- 1-year free delivery through DoorDash

Chase Ultimate Rewards Airline Partners:

- Aer Lingus AerClub

- Air France/KLM Flying Blue

- British Airway Avios

- Emirates Skyward

- Iberia Plus

- JetBlue TrueBlue

- Singapore Airlines KrisFlyer

- Southwest Airlines Rapid Rewards

- United Airlines MileagePlus

- Virgin Atlantic Flying Club

- World of Hyatt

- IHG Rewards Club

- Marriott Bonvoy

Note: All of these transfer partners have different airlines, routes, and the values of their points are different at different times and days. Please see our upcoming blog on maximizing Chase Ultimate Rewards Points for information on the best practices when transferring points to partners. Also, many of these partners have co-branded cards that you may want to add after you get the trifecta if you are sure to be flying with them. Only get co-branded cards if you are sure to use the miles within two years, and you are sure to get the welcome bonus. The rewards are very limiting and using them for everyday expenses is normally on a 1 point per dollar basis. We will have specific approaches based on specific airlines and destinations soon and will list them below as they come available.

Below is a very comprehensive review of the Chase Sapphire Preferred card.

How to best get and use the Chase Trifecta to maximize your reward

The way I chose to get these cards was less than optimal as far as timing to take full advantage of all the welcome bonuses. Mostly, this was due to getting the Sapphire card first and prompting me to start paying the $95 per year earlier than I needed, but it also was a mistake to get the two freedom cards within 3 months of each other which limits my ability to fully capitalize on the 5% grocery bonus for a full 2 years.

I have figured out a much better timetable for most people and have formulated a timing plan for both single people and couples that I will share with you below. With these timetables a single person can get over 220,000 points (worth $2,200-$5,500) over 2 years, while a couple can get twice that much or more.

I have figured out a much better timetable for most people and have formulated a timing plan for both single people and couples that I will share with you below. With these timetables a single person can get over 220,000 points (worth $2,200-$5,500) over 2 years, while a couple can get twice that much or more.

Chase Trifecta Card Acquisition Timetable and Instructions for Maximizing Rewards Points Earning

Single Person’s Guide to When and How to Get and Use the Chase Trifecta

- ASAP: Get the Chase Freedom Unlimited and use it for everything until you have spent $500

- This will be your grocery card for this year to take advantage of the 5% back, except while you are spending the $4000 to get the bonus on the Sapphire Card

2. Two to Six months after you get the Unlimited: Get the Chase Sapphire Preferred card when the bonus increases above the 60,000 mark or before you make any major purchases.

- Put every charge on this card until you reach the $4000 bonus

- Afterward, you will only use this card for travel purchases and to transfer points to partners from all 3 cards.

3. 11 ½ months after you received your Freedom Flex: Get the Chase Freedom Flex card and use this on everything except the 5% rotating categories from the Freedom Flex and Travel.

The minimum you should earn if you spend the required amount to reach all three three welcome bonuses is 220,000 points after 2 years. This can be used for 2-5 economy, Round Trip tickets to nearly anywhere in the World, depending on how far you want to go. It also gives you the option to combine nearly free flights with free hotel stays if you tend to travel less often. It can even pay for 2 Round the World Tickets if you really want to get tricky.

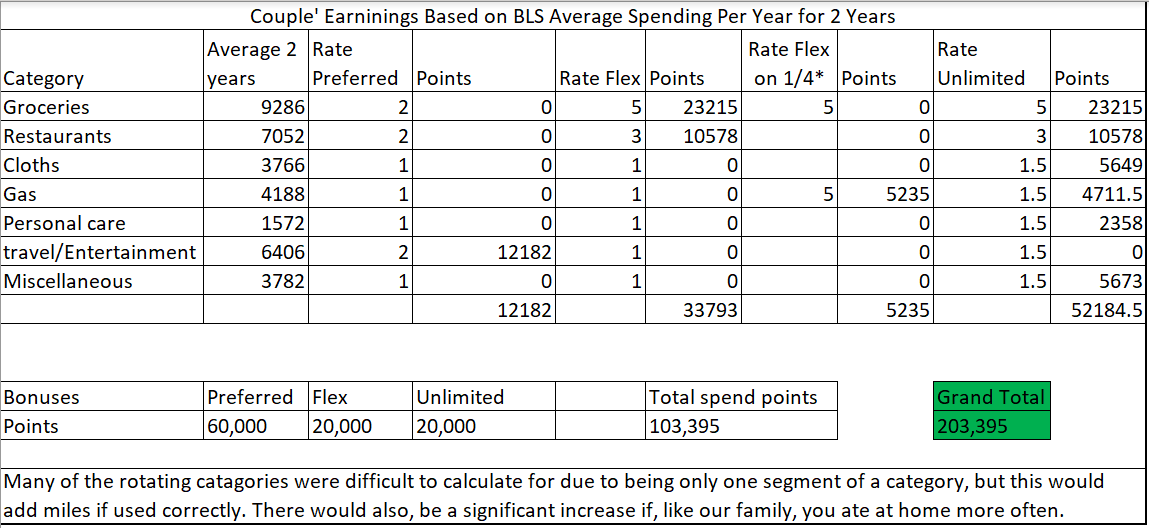

If you spend in accordance with the average American’s spending according to the U.S. Bureau of Labor Statistics, the chart below would be your points earning after 2 years, but this will be less or more based on your spending habits:

If you spend in accordance with the average American’s spending according to the U.S. Bureau of Labor Statistics, the chart below would be your points earning after 2 years, but this will be less or more based on your spending habits:

Couple’s Guide to When and How to Get and Use the Chase Trifecta

- ASAP: You should both get the Chase Freedom Unlimited and use it for everything until you have spent $500 each.

- Transfer the payment of your mobile phone bill onto this card as soon as you can to take advantage of the mobile phone insurance

- This will be your grocery card for this year to take advantage of the 5% back, except while you are spending the $4000 on the Sapphire Card

2. 2 to 4 months in: One of you should get the Chase Sapphire Preferred card when the bonus increases above the 60,000 mark or before you make any major purchases.

- Put every charge on this card until you reach the $4000 bonus

- Afterward, you will only use this card for travel purchases and to transfer points to partners from all 3 cards.

3. 3 months later: Refer the Sapphire Preferred Card to your spouse or significant other for an extra 15,000 points

• Put every charge on this card until you reach the $4000 bonus

• Put every charge on this card until you reach the $4000 bonus

4. 11 ½ months after you received your Freedom Flex: Get the Chase Freedom Unlimited card and use this on everything except the 5% rotating categories

from the Freedom Flex and Travel.

from the Freedom Flex and Travel.

The minimum you should earn if you spend the required amount to reach all three bonuses is 445,000 points after 2 years, which can be used for 4-10 economy, Round Trip tickets to nearly anywhere in the World, depending on how far you want to go. However, due to the spending power of a couple, you could earn much more’ leading to multiple dream trips where all you pay are taxes, food and entertainment.

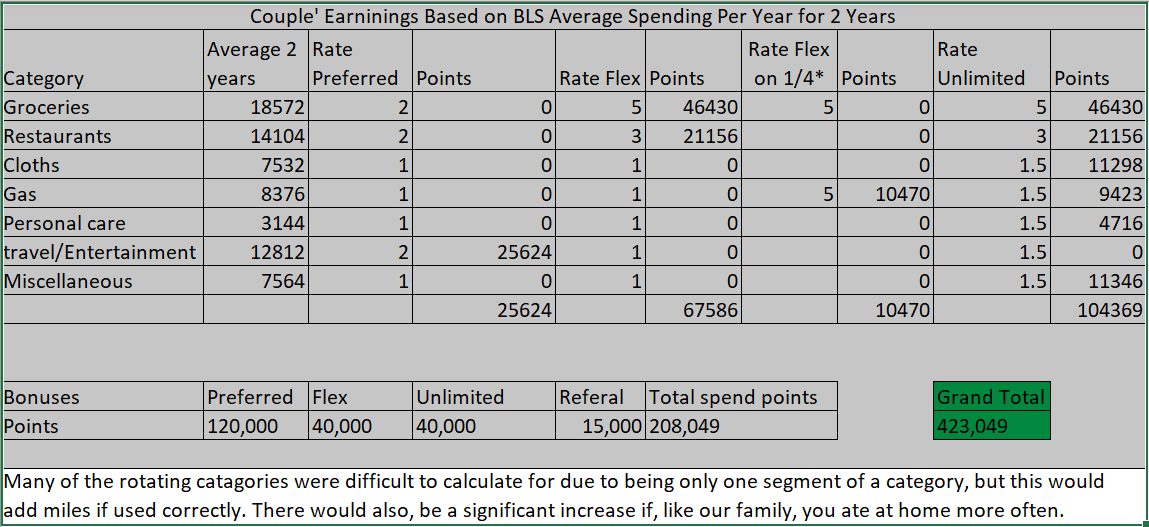

If you do only spend in accordance with the average American’s spending according to the U.S. Bureau of Labor Statistics, the chart below would be your points earning after 2 years (Families with dependents would result in significantly more points over the 2 year period):

If you do only spend in accordance with the average American’s spending according to the U.S. Bureau of Labor Statistics, the chart below would be your points earning after 2 years (Families with dependents would result in significantly more points over the 2 year period):

These points can be redeemed as $4,230.49 in cash, $5288.11 in travel through the Chase portal, or an average of $8,460.98 through proper use of travel partners. Here we have given you the keys to unlock over $4,000 per year of free travel and this is just the beginning.

If you travel often or own a business, check out the YouTube video below for a more expensive, but higher reward Chase Trifecta.

If you travel often or own a business, check out the YouTube video below for a more expensive, but higher reward Chase Trifecta.

Through the links here, you will receive the best available bonuses and, when you sign up through these, you will be helping support our efforts to educate travelers and produce more blogs and vlogs for YouTube. Please bookmark this blog and return when you are signing up for further Chase Card to complete your Trifecta or supplement it with cobranded cards or business cards as the situation warrants their addition. We thank you for taking the time to read this and we sincerely hope you take advantage of this to travel more, and do it more responsibly. Please come back every Saturday at 3pm Eastern Time for more valuable content and leave us questions and suggestions below?

If this has helped you please share it far and wide through telling people and sharing on social media. Your friends and family will love you for helping them get paid back from their everyday shopping as much as you will. Ou primary goal is to see people travel more and more responsibly, Also, please consider partnering with us on our mission on Patreon. Sponsorships start at $3/month, which is less than 1% of what you will make by following this plan.

Guiding Principles for Optimal Use of Travel and Cash Back Rewards Cards

- Pick the right card(s) for your lifestyle (We will make a separate blog for this in a month or so)

- Unless there is a discount for cash, always pay with rewards credit cards (debit cards should stay in your wallet)

- Target a minimum of 2% rewards on common categories of spending like groceries, gas, restaurants, travel, etc. and get more when you can

- Make sure you spend the minimum to get your welcome bonus, these can be valued as much as $1600 (Chase Sapphire Preferred as of November 2020).

- Spend on credit cards only what you would spend normally

- Pay off your balances; carrying credit card balances costs you much more then the rewards you earn

- Unless you need the cash, transfer cash back to points because they are always worth more when spent on travel expenses

- Use the card with the best bonus for each transaction (easier than you think with a trifecta)

- Get Chase cards first if you are going to eventually graduate to travel hacking, credit card churning or other more expansive credit card circulations like we do, and come back often for updates and suggestions.

Bonus: If you are using the points for miles, use skyscanner.com to find the airline partner with the best deals to your destination and consider a co-branded card from the selected airline in your second year and beyond. This will add 40,000-80,000 more miles per card. We will be adding a blog on this soon

We are writing similar strategies for several of the other Chase Transfer Partners, if you prefer these carriers and will link them below as they are completed.

1. Airline Partners with great supplemental strategies to earn more miles:

2. Hotel Partners with good supplemental strategies to earn more miles:

Important: The instructions in this guide are based on current credit card incentives. We will periodically update them to keep them accurate, but there is no way to guarantee that the particular costs and incentives will be available at the time you choose to enroll in the services we suggest here. They could be better or worse. We are doing this as a service to you and may be compensated from other organizations for referring you to their services. Always read all credit card agreements and terms carefully before signing up, and remember to spend responsibly to avoid interest and fines.

These strategies can be a great tool to enrich your life and can improve your credit when used correctly, but irresponsible spending on credit cards can do just the opposite. We attempt to influence people towards what we think is the best strategy for them, but we are not experts or professional financial advisors. Please monitor your credit and spending. We suggest you adjust these schedules as needed to keep or advance your credit at the level you are targeting. We keep ours in the mid to high 700s at all times and find that easy to do through paying off all credit card debt every month, and never paying any creditors late. You should too.

Please leave us any questions below or contact us on our Facebook or Instagram accounts @oldsolestravel . We do our best to help you save money, travel more, and “Find Yourself on the Journey”.

1. Airline Partners with great supplemental strategies to earn more miles:

- British Airways, Aer Lingus, and Iberia Airways (our best overall, meant for flying a lot on shorter hops anywhere in the World and, especially, for flying around Europe)

- Southwest Airline (Our best for Flying from coast-to-coast and to Central America)

- United Airlines ( our best for flying up and down the East Coast).

2. Hotel Partners with good supplemental strategies to earn more miles:

- Marriot Bonvoy

- Hyatt

- IHG

Important: The instructions in this guide are based on current credit card incentives. We will periodically update them to keep them accurate, but there is no way to guarantee that the particular costs and incentives will be available at the time you choose to enroll in the services we suggest here. They could be better or worse. We are doing this as a service to you and may be compensated from other organizations for referring you to their services. Always read all credit card agreements and terms carefully before signing up, and remember to spend responsibly to avoid interest and fines.

These strategies can be a great tool to enrich your life and can improve your credit when used correctly, but irresponsible spending on credit cards can do just the opposite. We attempt to influence people towards what we think is the best strategy for them, but we are not experts or professional financial advisors. Please monitor your credit and spending. We suggest you adjust these schedules as needed to keep or advance your credit at the level you are targeting. We keep ours in the mid to high 700s at all times and find that easy to do through paying off all credit card debt every month, and never paying any creditors late. You should too.

Please leave us any questions below or contact us on our Facebook or Instagram accounts @oldsolestravel . We do our best to help you save money, travel more, and “Find Yourself on the Journey”.

2 Comments

Becky S.

11/24/2020 05:00:59 pm

I have been doing something similar to this for 2 years now, it is really amazing. I do like to use the sapphire reserve, however. What I am loving is the Southwest supplement that you wrote and I think I might do that. Thank you very much. Do you think the Southwest supplement is the best for someone who travels from New York to the mountain Time zone?

Reply

Corey Kerkela

11/25/2020 09:43:05 am

If that is primarily the flights that you take, I would say this is a great option for you. Southwest is a great airline and they have a lot of nice cards that supplement this trifecta.

Reply

Leave a Reply.

Authors

Turtle and Bear travel far and wide on a very limited budget. This page is dedicated to inspiring others to travel and how to make the most of your oportunities and budget.

Archives

Categories

Click Below for More Great Content:

Please consider supporting Old Soles Travel in our mission to promote sustainable travel and the organizations that provide these services by joining our Old Soles support team at Patreon.com. Plans begin at $3/month and go a long way towards accomplishing our goals and continuing to provide you with quality travel content.

RSS Feed

RSS Feed