|

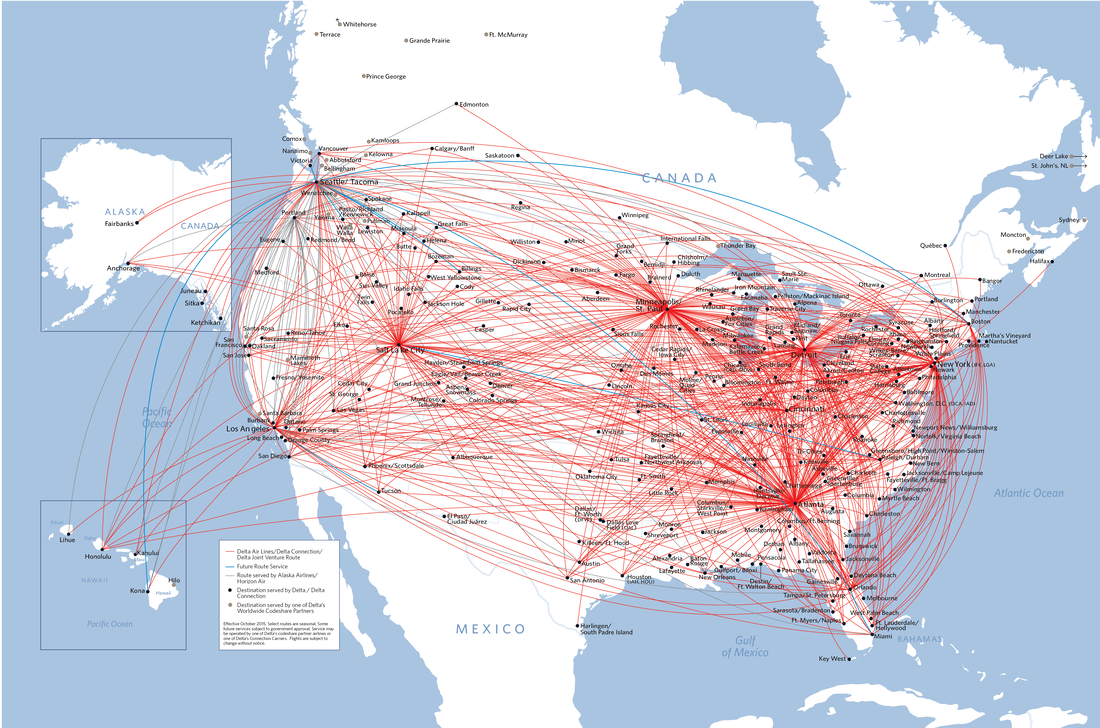

Full Transparency: We are not monetizing any of our content at this time. Opinions and product recommendations on this site are not those of the credit card companies suggested, being ours alone. Our Favorite Strategy for Accumulating Lots (Hundreds of Thousands) of Reward Points for Use on Delta Airlines through American Express Gold Card and Two of the SkyMiles CardsDelta the best U.S. airline for Floridians in most cases, as they have affordable prices and several routes out of local airports where other carriers are lacking. This is probably due to the proximity of Atlanta. Being based in Florida, Old Soles Travel flies with Delta regularly on both domestic and international flights and, therefore, value Delta points highly and seek to keep our balance of these points at an adequate level at all times. Map of Delta's North American Routes from https://news.delta.com/route-map-us-canada If you live in South Florida or near one of Delta's Hubs this is probably the best strategy for you to start with on your travel rewards journey, like it was for us. The best strategy to do this without spending exorbitantly on annual fees is outlined here. However, this strategy is secondary to our Chase Trifecta strategies as the return on fees is lower with this plan. In fact, while we suggest three cards over the first two years to accumulate points, we only keep two of these cards active in our wallets. Using this strategy for 2 years will earn roughly 206,500 points for the average American if they spend in accordance with the average spending documented in the 2019 Bureau of Labor Statistics Report. After the 2 year point there are other supplemental options in the form of additional American Express Cards, higher fee carrying Delta cards, Business cards, and even using Marriot Bonvoy cards to accumulate Delta points, but we suggest switching to Chase at some point unless you live very close to a Delta hub. Below we suggest a timetable and strategy for individuals and couples to maximize their Delta Rewards. Annual points earned by average American through this strategy if done right. Year 1: 156,000 Points 95,000 Amex: 51,000 Delta Year 2: 50,500 Points 40,000 Amex: 10,500 Delta 2-Year Total 206,500 Points 130,000 Amex: 73,500 Delta To Learn more about how to earn roughly 200,000 points towards Delta Rewards flights in two years, click read more below. Click "Read More" below to learn more about how to maximize your Delta SkyMiles Earning Strategy for Individuals and Couples

0 Comments

Full Transparency: We are not monetizing any of our content at this time. Opinions and product recommendations on this site are not those of the credit card companies suggested, being ours alone. Guide to Flying Free all over through British Airways, Aer Lingus, and Iberia Airlines Avios Programs starting with Chase Credit Cards and graduating to American Express after 3 years. Note: This is intended as a supplement to the Chase Trifecta for those who travel frequently on relatively short hops anywhere in the World, or on long-haul flights that are available through Aer Lingus or Iberia. Other approaches are better for other people. See this Guide to decide which approach is right for you. If you travel on short-distance hops within the U.S. or most anywhere in the World, this is by far the best strategy for you to make the most out of your credit card rewards. In fact, this is the current strategy that I am using to prepare my friends and family for our upcoming Alps and Oktoberfest trips, and several trips around Europe thereafter. It is amazingly lucrative for travel around Europe.

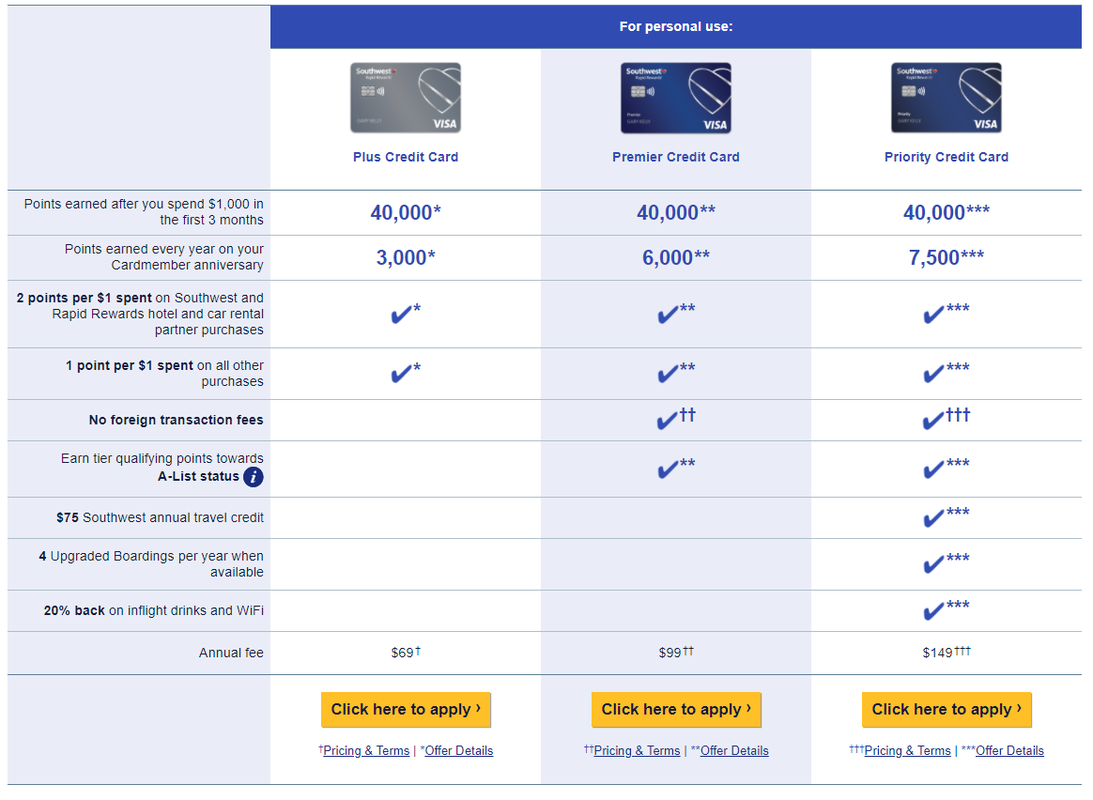

Done right, this will result in roughly the following rewards for someone who spends at least the averages for Americans according to the Bureau of Labor Statistics: Year 1: 131,000 Points/Per Person 131,000Chase Year 2: 123,000 Points/Per Person 70,000Chase:53,000 Avios Year 3: 89,000 Points/Per Person 36,000Chase:53,000 Avios Year 4: 149,000 Points/Per Person 96,000Amex:53,000 Avios 4-year Total: 492,000 Points/Per Person 237,000Chase:159,000 Avios:96,000 Amex Avios points can be very valuable, especially when flying less than 1150 miles per leg, and especially in Europe where flights less than 650 miles start at only 4,000 miles. This is a must do if you are planning to travel with multiple destinations on the same continent. However, if you use Avios points to fly across oceans you must transfer any British Airways Avios to Aer Lingus or Iberia to avoid fuel surcharges that are quite expensive. To avoid this, transfer some of your Chase or Amex points to another Airline partner for the transoceanic portions of the trip. We tend to keep our Chase and American Express rewards separated from Airline rewards programs for flexibility and only transfer them to the Avios Programs when we need more points than we currently have in our Avios accounts. Below, we will cover the schedule of how to best use this strategy to earn the most possible points over a 4-year period for an individual and for a couple below that. For the specifics on the Chase Trifecta, which will be the cards you get and use over the first 12-18 months, please see our more detailed blog on their specifics and why they are the best travel platform for vacation travelers here. Click Below to Learn More About How To Easily Earn Nearly Half a Million Points in Four YearsFull Transparency: We are not monetizing any of our content at this time. Opinions and product recommendations on this site are not those of the credit card companies suggested, being ours alone Guide to Flying Free on Southwest Airlines through Chase Credit Cards If your travel goals are within the Americas and you are loyal to Southwest Airlines, this credit card strategy can get you well over 250,000 miles in Southwest Rapid Rewards Points per person in the first two years. This is a supplement approach to our favorite credit card strategy. A more detailed description of why and how to fly free with Chase credit cards is available by clicking here. Southwest Airlines is our favorite airline for flying to the West Coast, Mountain States, and Central America. Like many people, our first thought on how to earn points for Southwest Airlines was to get one of the three Rapid Rewards Cards by Chase. However, despite the very attractive bonus offers noted below, using the Chase Trifecta as your first and primary means of earning points on Southwest, both in the first 2 years and afterwards will almost always result in more point.

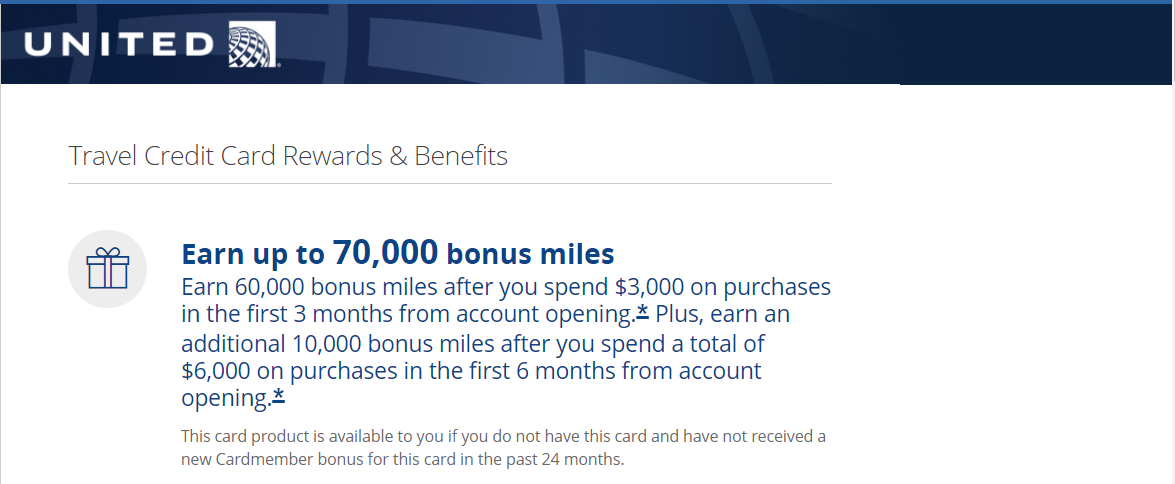

This does not, however mean you should not get the Rapid Rewards cards. In fact, if you are loyal to Southwest for most of your flying, I would suggest all three at some point in the first 4 years of this strategy, dependent on how often you fly. Done right, this will result in roughly the following rewards for someone who spends at least the averages for Americans according to the Bureau of Labor Statistics: Year 1: 131,000 Points/Per Person 131,000Chase:0Southwest Year 2: 111,000 Points/Per Person 70,000Chase:41,000 Southwest Year 3: 81,000 Points/Per Person 40,000Chase:41,000 Southwest Year 4: 81,000 Points/Per Person 40,000Chase:41,000 Southwest Total for 4 years: 404,000 Points/Per Person 281,000Chase:123,000 Southwest Southwest points can be very valuable, especially when Southwest is having a sale. This is because Southwest allow you to use your points at a rate of 1.5 cents to 1 point off of their current pricing. In fact, their fares can sometimes be as low as 5500 points each way. This can lead to dozens of nearly free short flights or several longer, round trips. Therefore, we tend to keep our Chase rewards separated for flexibility and only transfer then to Southwest when we need more than we already have or in the first two years when we are primarily earning Chase Points. Below, we will cover the schedule of how to best use this strategy to earn the most possible points over a 4-year period for an individual and for a couple below that. For the specifics on the Chase Trifecta, which will be the cards you get and use over the first 12 months, please see our more detailed blog here. Click Below to Learn More About How You Can Earn Over 400,000 Points with Chase Credit CardsFull Transparency: We are not monetizing any of our content at this time. Opinions and product recommendations on this site are not those of the credit card companies suggested, being ours alone Guide to Flying Free on United Airlines through Chase Credit Cards Note: This is intended as a supplement to the Chase Trifect for those who are loyal to United Airlines or who predominantly fly on the Eastern Seaboard. Other approaches are better for other people. See this Guide to decide which approach is right for you. If your travel goals are within the United States with some trips to Europe sprinkled and you are loyal to United Airlines, this credit card strategy can get you well over 236,000 miles in Southwest Rapid Rewards Points per person in the first two years. This is a supplement approach to our favorite credit card strategy. A more detailed description of why and how to fly free with Chase credit cards is available by clicking here. United Airlines is our favorite airline for flying to and around the portions of the United States East of the Mississippi River. This is due to a many smaller airports being included in their route map from Orlando and a strong international route map from Orlando and New York City.

It is rare for us to suggest that you get a credit card that is cobranded before starting with the Chase Trifecta because the Freedom cards have better spending categories, and all the points can be transferred 1:1 to United through the Chase Sapphire Preferred card. However, the current 70,000 mile welcome bonus on the United Explorer Card and the free baggage is too hard to pass up for frequent flyers of United Therefore, we are recommending a different approach to United points than we usually do. While we usually use cobranded cards to supplement the Chase Trifecta, we suggest that you start with the United Explorer card in this strategy and long as the welcome bonus remains 60,000 points or higher. Done right, this will result in roughly the following rewards for someone who spends at least the averages for Americans according to the Bureau of Labor Statistics: Year 1: 116,000 Points/Per Person 40,000Chase:76,000 United Year 2: 120,000 Points/Per Person 120,000Chase:0 United Year 3: 61,000 Points/Per Person 40,000Chase :21,000 United Year 4: 40,000 Points/Per Person 40,000Chase:0 United Total for 4 years: 337,000 Points/Per Person 240,000Chase:97,000 United Click below to Learn More About How to Earn 337,000 Miles with Chase Credit Cards |

Author,Turtle and Bear love to travel and do so, far and wide, on Park Ranger salaries which can be quite a challenge. Here we teach you to leverage credit card benefits to save a lot of money and travel better, more often, and for much less $$$$ than you think. ArchivesCategories |

Click Below for More Great Content:

Please consider supporting Old Soles Travel in our mission to promote sustainable travel and the organizations that provide these services by joining our Old Soles support team at Patreon.com. Plans begin at $3/month and go a long way towards accomplishing our goals and continuing to provide you with quality travel content.

RSS Feed

RSS Feed